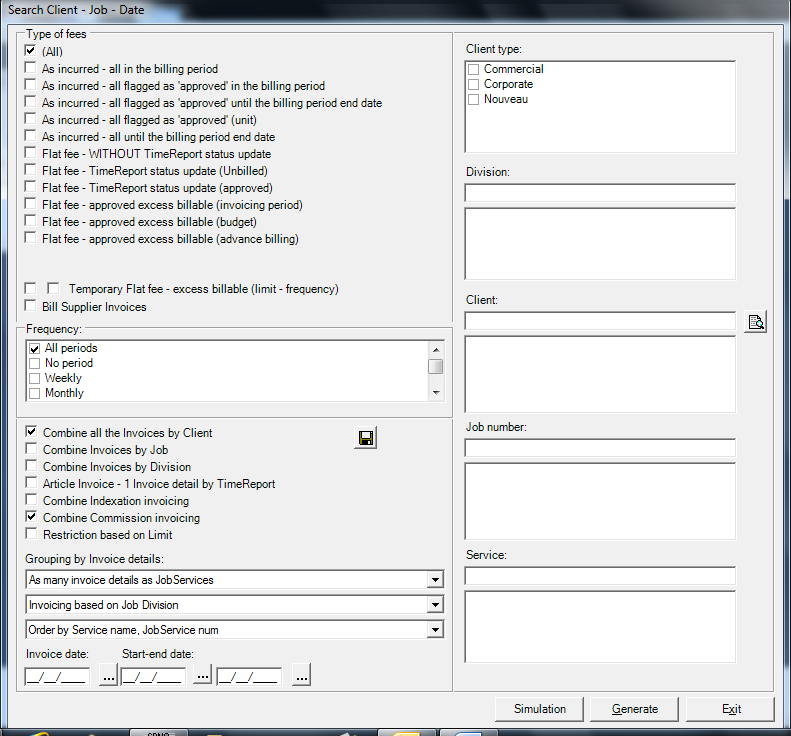

General description

This form is used to luanch automatic invoicing. It is under menu: Application – Batch operations (Non accounting)

This form is used to luanch automatic invoicing. It is under menu: Application – Batch operations (Non accounting)

After “Generate” button, all the job service lines corresponding to the criteria are readen and generate client or supplier invoices. To define job service lines, you must enter values on screen under Client – Services on Job.

At the run launch, there are three dates:

Invoice date: will be used as invoice date.

Start date: date from which DeMaSy will browse the timereports.

End date: date until which DeMaSy will browse the timereports.

If no end date is specified the invoice date will be considered as being the end date. Start date and End Date is referred to as the billing period.

METHODS DESCRIPTION

Flat fee methods

Timesheets value has not impact on these billing methods.

- Method 1: Flat fee – WITHOUT timereport status update

The status of the timereport existing for the selected service and/or timereport type will not be modified and remain “unbilled”. - Method 2: Flat fee – Timereport status update (unbilled)

All the timereport with “unbilled” status will be flagged as “billed” - Method 3: Flat fee – timereport status update (approved)

Only the timereport with status approved will be flagged as “billed”

As incurred methods

- Method 1: As incurred – all in the billing period

All timereports in the specified billing period will be billed. - Method 2: As incurred – all flagged as approved in the billing period

All timereports in the specified billing period with “approved” status will be billed. - Method 3: As incurred – all flagged as approved (unit)

Same as method 2 but with a rounding of the hours billed.

Timereports under 1:00 will be billed as 1:00

Timereports > 1:00 will be rounded up by 15 min. - Method 4: As incurred – all until the billing period end date

All timereports in the specified billing period OR BEFORE will be billed. - Method 5: As incurred – all flagged as approved until the billing period end date

All timereports in the specified billing period OR BEFORE with “approved” status will be billed.

Combination Flat fee and incurred methods

For these methods, it is to be noted that if JobService End date is specified, flat fee can not be billed after this date, but the approved excess, yes. (always if invoicing period is covered). The considered flat fee to calculate excess is so zero.

To stop really automatic invoicing, the JobService lines must be defined on “Automatic invoicing = NO”.

- Method 1: Flat fee – Approved excess billable (invoicing period)

The system will bill a flat fee and the approved excess (if any) in the invoicing period.

To be noted that invoice will only be raised if the specified billing period is complete (For a yearly billing for example the billing period specified must cover the year)

-

Method 2: Flat fee – Approved excess billable (budget)

The flat fee is billed as stated in the fees field.

The periodic flat fee is extrapolated on a yearly basis to obtain a yearly budget which will be considered as the flat fee based on which the potential excess will be billed.Ex: Monthly flat fee: 1.000 EUR

The yearly budget will then be 12.000 EUR

The excess will be billed only if the value of the approved timereports exceed 12.000 EUR.

- Method 3: Flat fee – Approved excess billable (advance billing)

A flat fee is billed at the beginning of the period with no reference to the specified invoicing period.

Any APPROVED excess will be billed.Remark :

In the billing methods based on flat fee and excess the timereport billed are attached to the details (lines) of the invoices. However when billing an excess there will always be a “hinge” or “pivotal” timereport which initiates the excess. This particular timereport will be attached to the detail of the invoice stating the excess. - Method 4: Temporary flat fee – billing in progress

This method is the same than method 3 but with a specific dynamic.

In the three first methods the flat fee generates an invoice and each excess is billed separately in a new invoice by difference.

With this method the flat fee is considered as an advance. Therefore when an excess is reached, a new invoice in produced in which the flat fee will be credited (appear in negative) in one line of the invoice and the total timereport value will be invoiced separately in another (other) line(s).Example:

01/01: Flat fee 1.000 EUR

As of 31/03 there is an excess of 250 EUR

The invoice as of 31/03 would contain two lines:

Advance credit – 1.000 EUR

Incurred hour + 1.250 EURIn this particular method before being in a situation of excess all the timereport are attached to the first invoice (flat amount considered as an advance).

When coming to a situation of excess the flat fee (advance) is reversed on the new invoice and the total value of the timereports is billed. All the timereports will be attached to this excess billing line and no longer to the first invoice of the advanceBill Supplier invoices

This method is set to rebill to clients all the supplier invoices lines on which there is a job number specified and on which the flag rebill has been checked (set).

To be noted that for this method it is possible to define one automatic billing service line for all jobs at a time. This means that in that case the user doesn’t have to enter an automatic billing service line for each client.

Job number has been provided to supplier invoice line and the invoice check box has been ticked.

As such the debit account is know by the system through the options (should be an account with type expense).