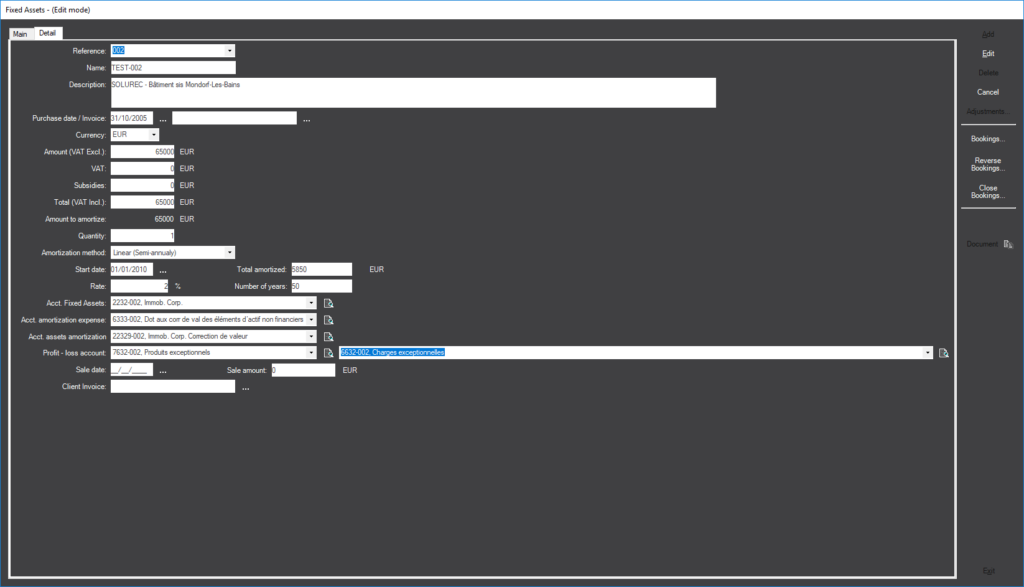

Fixed Assets screen

Fixed assets screen can be launched from accounting menu.

Fields description :

- Reference / Name / Description : text labels

- Purchase date / Invoice : it is possible to attach supplier invoice to the fixed asset. But, the purchase invoice must be booked individually.

- Amount to amortize : it is the amount used for amortization calculate. The other amounts are only informative.

- Amortization method : 5 possibilities:

1) None : no calculate will be done

2) Linear (Number of days) : calculate will be done on the day

3) Linear (Semi-annually) : calculate will be done in the nearest semester

4) Variable rate – constant basis

5) Constant rate – variable basis - Start date : generally, start date is the same than purchase date, but it is possible to enter different date (because of other informatic tool, per example).

- Total amortized : it is the amount already amortized before the use of DeMaSy functionality.

- Rate / Number of years : the amortization period. Ex : 20 % means during 5 years.

- Acct. Fixed Assets / Acct. amortization expense / Acct. assets amortization : Profit – loss account : all the fixed asset accounts used for accounting entries, according the case.

- Sale date : it implies a particular behavior at the launch of accounting. Like the zeroing of different accounts

- Sale amount : informative amount, not used on generation of accounting entries. However, it can be shown on the amortization report, according to the options choice.

See on : Q&A paragraph - Client invoice : informative value. The client invoice must be booked individually.