Fixed assets Booking – Case “Sale during amortization period – Linear (Number of days) method”

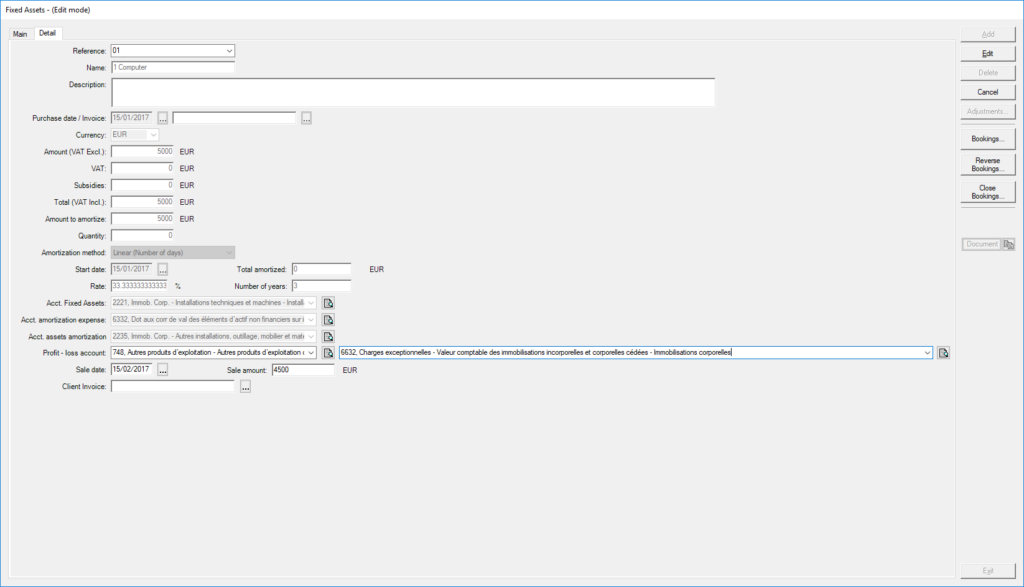

Here the fixed asset :

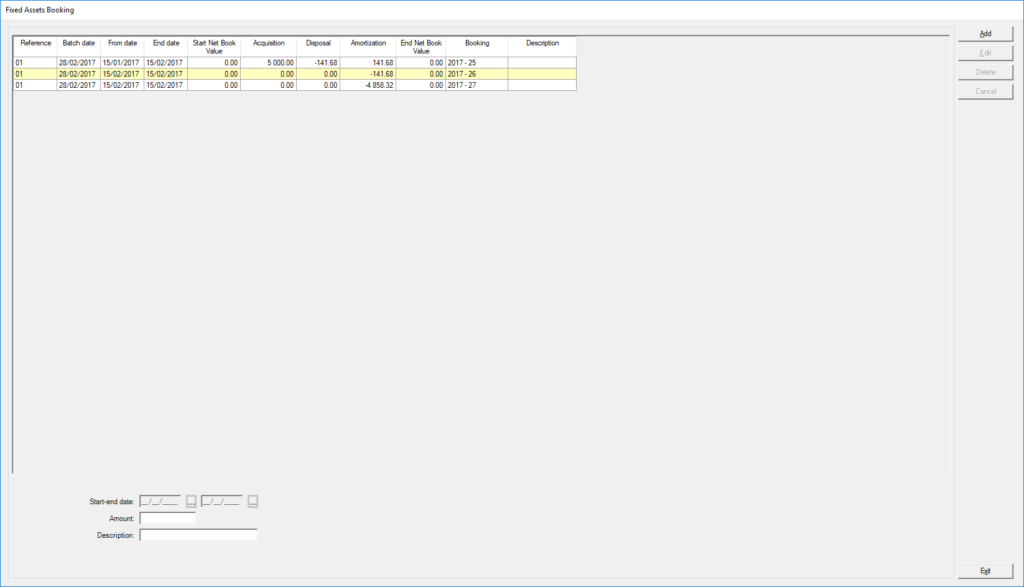

After booking at 28/02/2017 with “Booking” button, you can see the reflect of generated entries on the screen “Adjustments”.

Let’s summarize the asset data :

Purchase date : 15/01/2017

Sale date : 15/02/2017

Amort to amortize : 5000

Sale amount : 4500

Method : Linear (Number of days)

Number of years : 3

In this exemple, booking is launched at 28/02/2017, after sale but during the three years of amortization.

We have three entries:

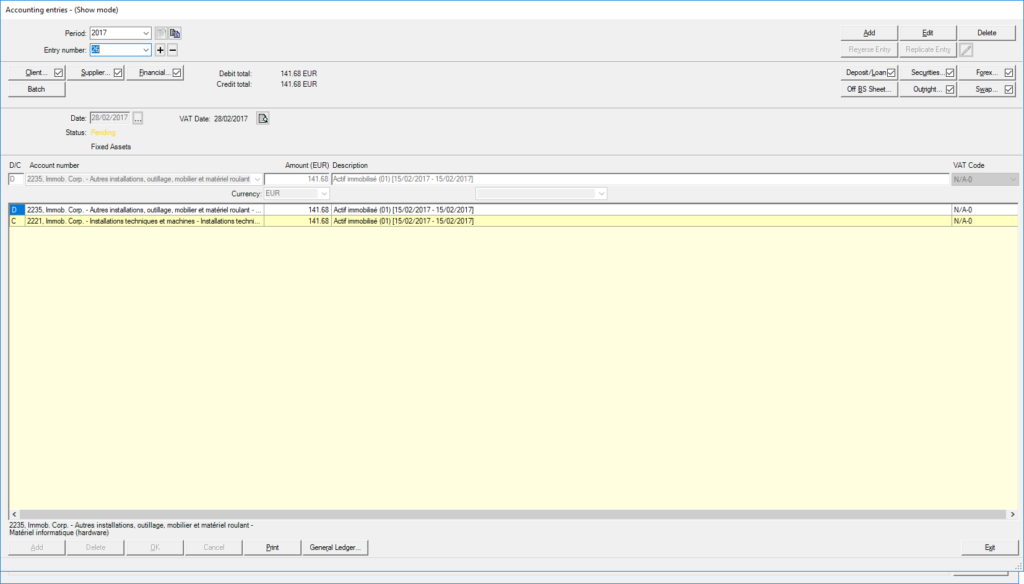

– The first one (entry ) for the amortization booking until the sale date: 141,68 EUR.

This amount corresponds to a specific calculate.

PERIOD AMORTIZATION=(FIXEDASSET AMOUNT / TOTAL DAYS) * PERIOD DAYS

TOTAL DAYS = the three years of total amortization period

PERIOD DAYS = from 15/01/2017 until 15/02/2017

In our exemple: 141,68 = (5000/1094) * 31

– The second entry () has for the total amortizated (Calculated and Beginning amount called on screen “Total amortized”)

In our exemple: 141,68 = 141,68 + 0

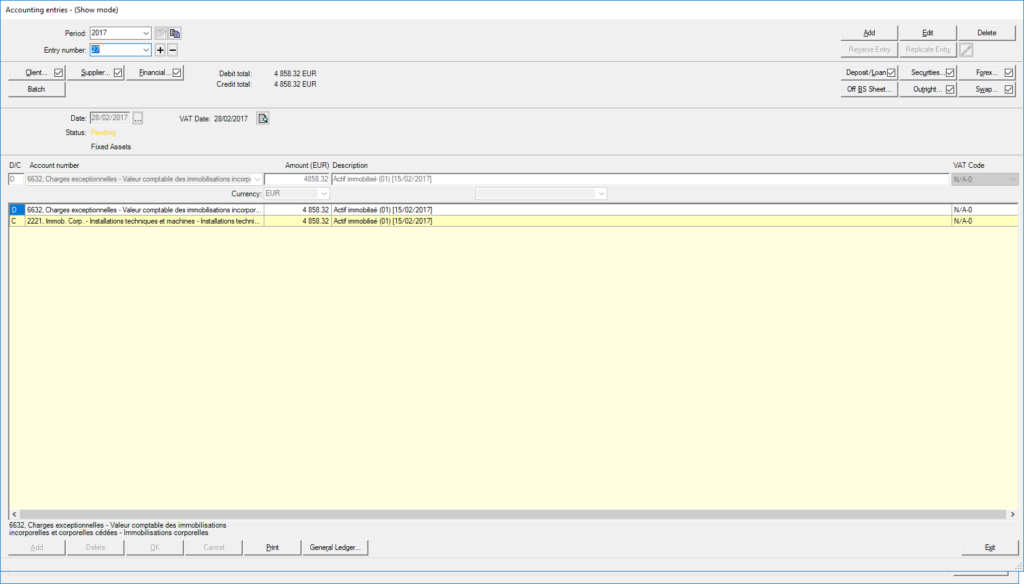

– The third entry () has for remaining amortization not incurred.

The calculate is remaining amortization = FixedAsset amount – Beginning amount – Amortization total

In our exemple: 4858,32 = 5000 – 0 – 141,68

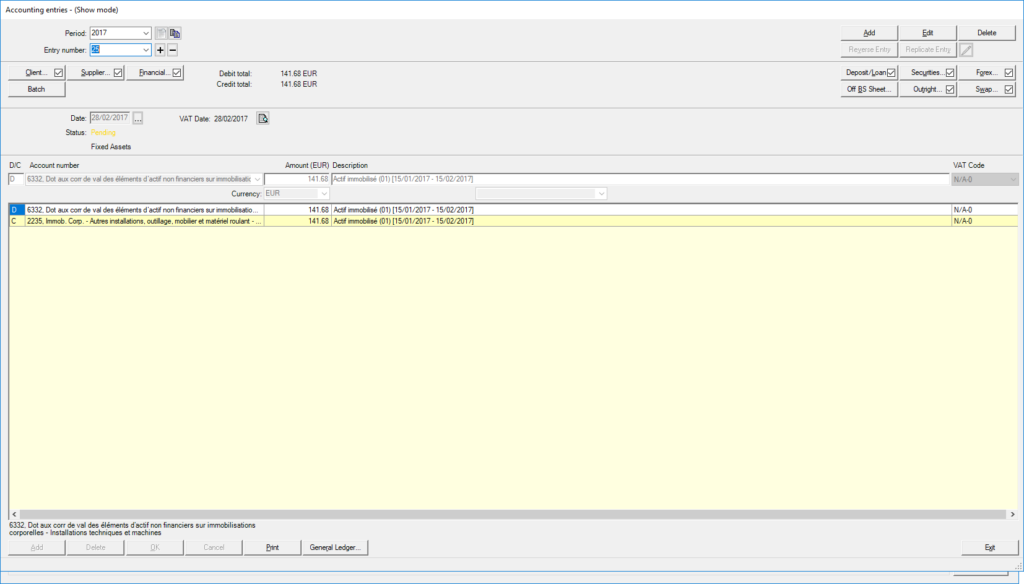

So, see the three entries:

Let’s summarize entries :

1 – D – Account 6332 – 141,68

1 – C – Account 2235 – 141,68

2 – D – Account 2235 – 141,68

2 – C – Account 2221 – 141,68

3 – D – Account 6632 – 4858,32 (B)

3 – C – Account 2221 – 4858,32

Two other entries must be found on database : purchase (4) and sale (5)

4 – D – Account 2221 – 5000

4 – C – Account 44111 – 5000

5 – D – Account 4011 – 4500

5 – C – Account 7632 – 4500 (A)

NB : The loss related to the sale will be reflected in the retained earning account. A loss of 358,32 equal to the difference between entries in color (A – B)

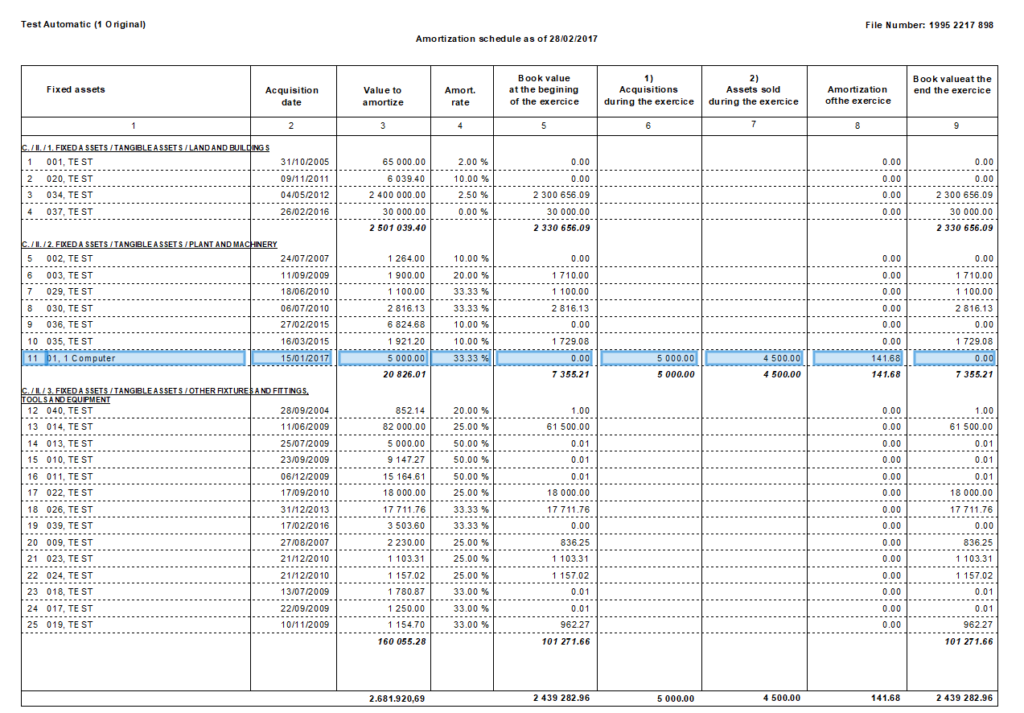

Also, a report exist and displays these information, Amortization schedule (Accounting) – VersionPrint 1157.

In our exemple, see report launched at 28/02/2017 (with options on “sale”), the line in blue :