IMPORTANT:

To use new the eCDF format for VAT declarations, DeMaSy must be imperatively upgraded to at least Version 7.

The year 2016 will be a transition year, so you can go through the eTVA or through eCDF website to file your VAT returns.

During the year 2016, you can file periodic VAT 2015, periodic VAT 2016, the annual VAT 2015 via eCDF platform. But, the VAT recapitulative statements will only go through the eTVA like periodic 2014 VAT declarations and the annual VAT 2014 (and older ones).

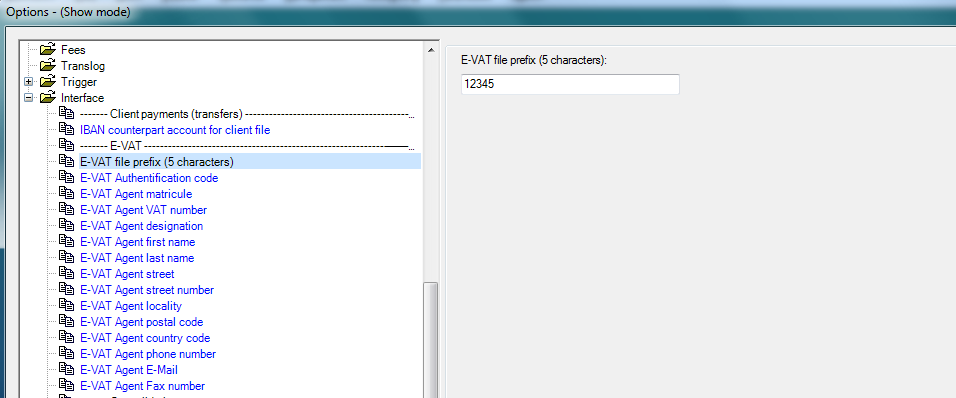

Necessary options

Before using VAT declaration functions, you must specify some options in DeMaSy.

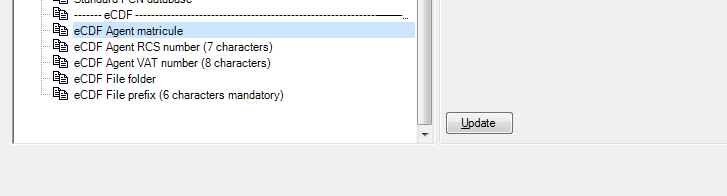

For eCDF file:

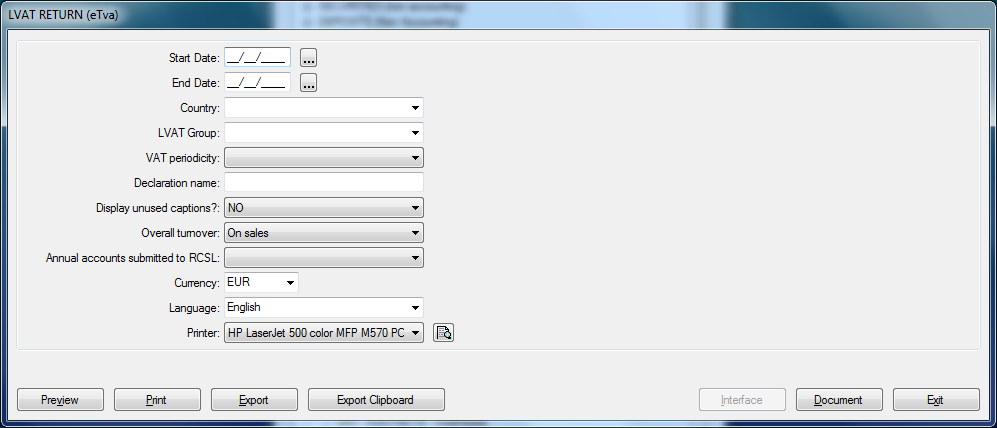

VAT Declarations can be displayed from DeMaSy reporting (Report 1163) : ACCOUNTING – VAT => LVATReturn (eTVA)

Then, select print criteria and then press on “Preview” button.

The VAT declaration XML file must be generated in two steps.

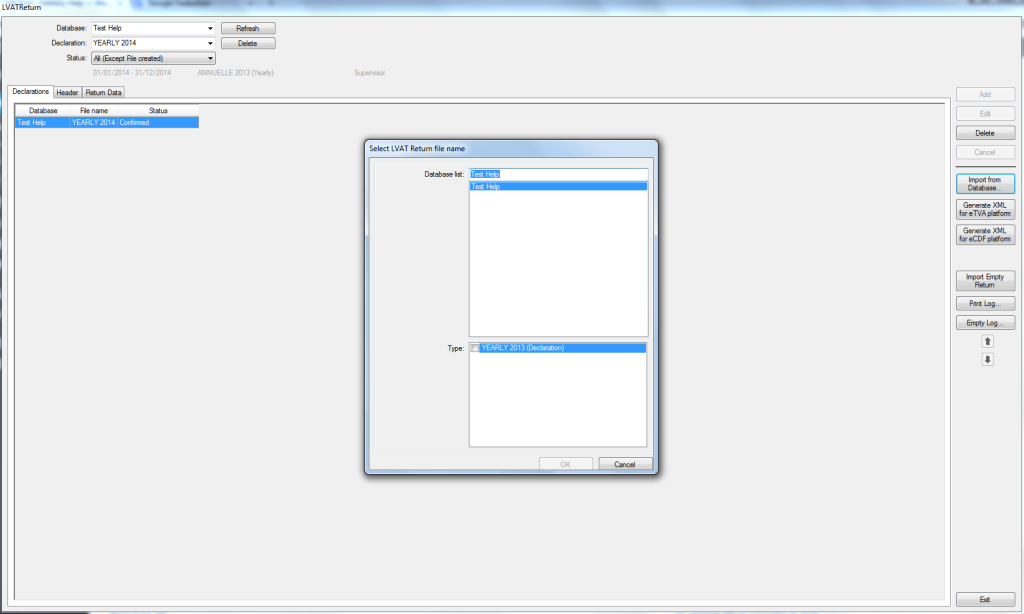

1) In DeMaSy, from the reporting (same report than the declaration viewer). Press the “Interface”. It is only enabled after the declaration name is entered. After this first step, the file is not generated but records are created and can be imported into the DeMaSy Utilities, to be reviewed, completed and confirmed by the user.

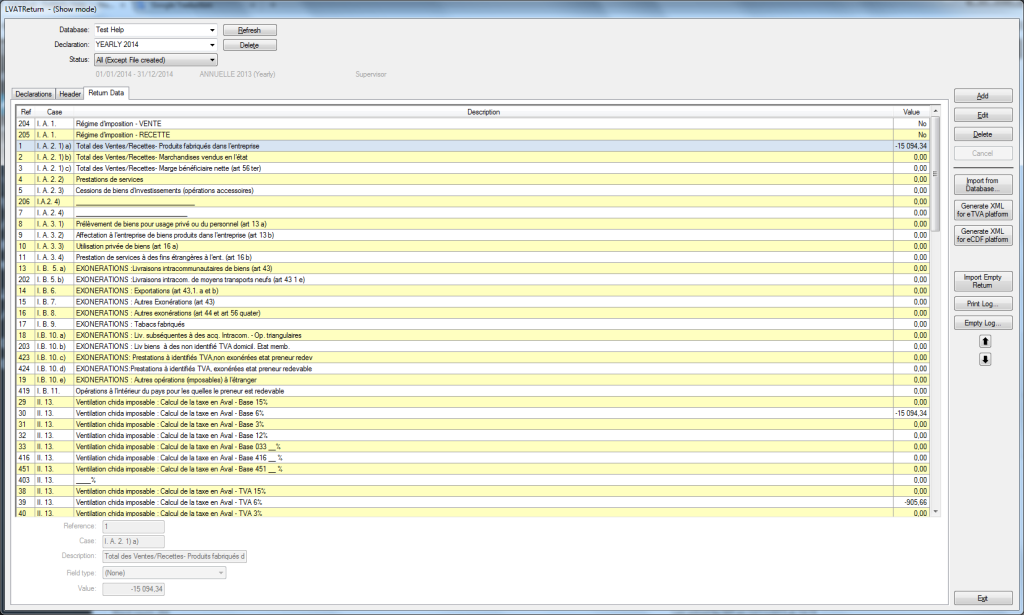

2) In the Utilities, the interface “Interface – eTVA” displays the screen to valid the declaration. Press on the “Import from Database” button and select the declaration to verify and confirm it.

Records are inserted into grid and can been updated.

Records are inserted into grid and can been updated.

When the declaration is correct, push on “Generate XML for eTVA platform” button or “Generate XML for eCDF platform” button and file is generated on path specified on the interface option.

When the file generation process is finished, the field status declaration becomes “Done” or “Rejected”. In case of a reject, a log file appears with the errors (listing from website).

VAT Footnotes

For annual return footnotes, user can add lines . Use the “Add” button to complete the declaration. In case of General Expenses annex, column “Ref” corresponds to the paper column and “Case” the paper line.