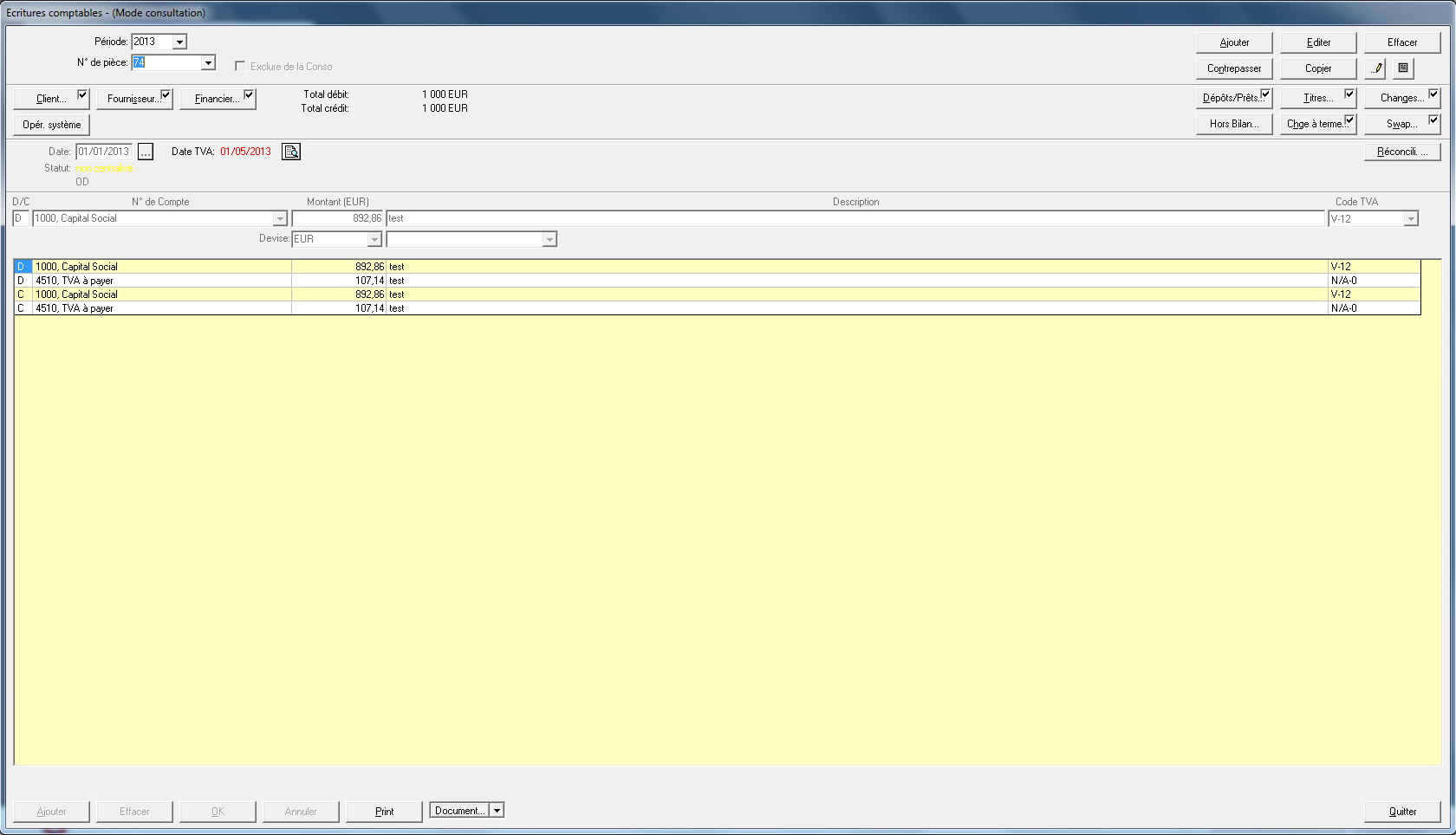

According to the client Licence, it is possible to have a GLMovement VAT date.

So, an entry can have an accounting date and a VAT date.

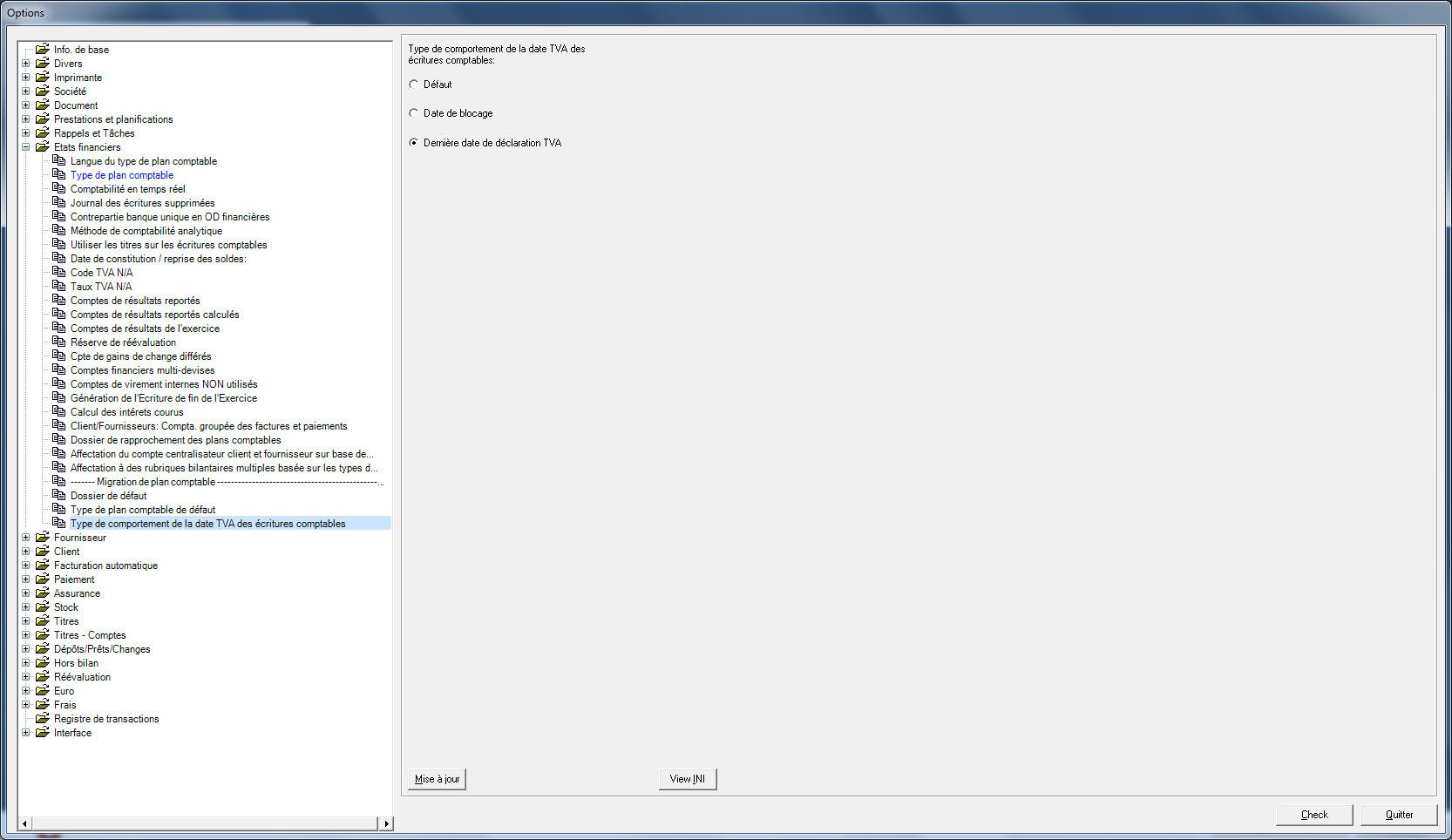

Also, specific behaviour can be parametered in the Options.

To resume different behaviour in the new entries, these cases :

– Default: in VAT date, the same date that accounting date

– Access date: the access date + one day

– LVATReturn date: the company last VAT return date + one day

You can modify this default date with the go Button at the right of the date, but some verifications are done by the program:

– in Default mode: VAT date can not be inferior to the accounting date

VAT date can not be inferior to the lock date

VAT must be in the active accounting period

– in Lock date mode: the same verifications are done

– in Last VAT return date mode: VAT date can not be inferior to the accounting date

VAT date can not be inferior to the last VAT return date

VAT must be in the active accounting period