DeMaSy VAT

Provided that the parameters are properly set VAT return under XML format will be generated by a single report export call (report id 1163).

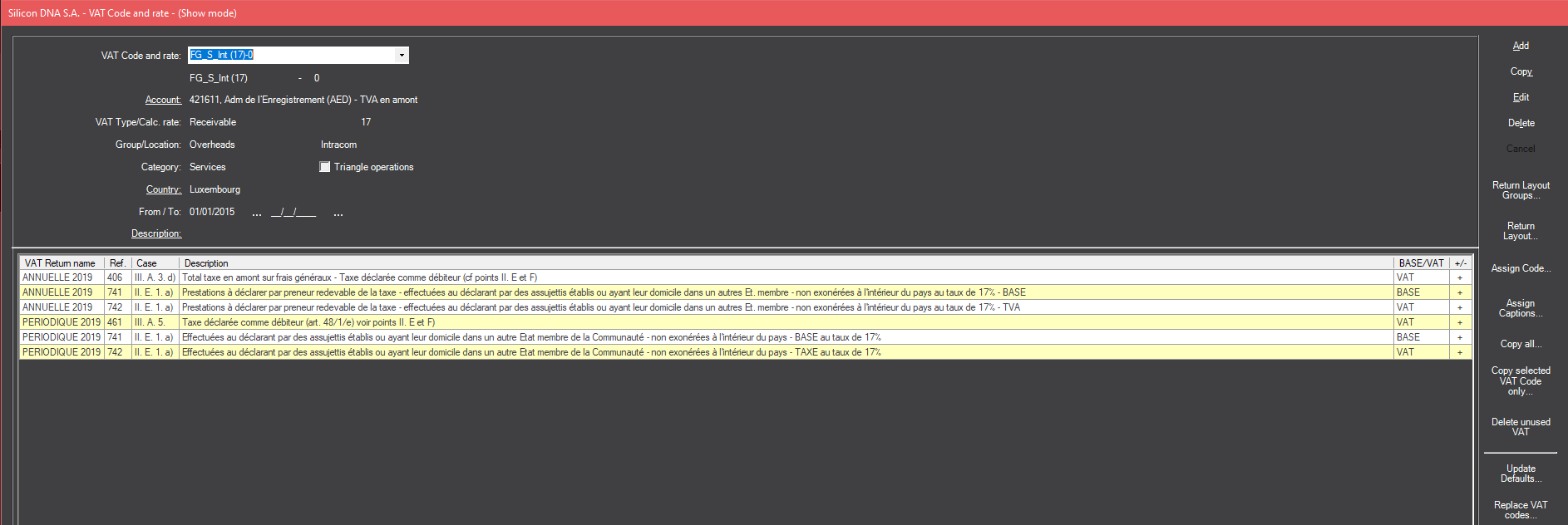

PARAMETERS : Menu : Accounting / VAT Codes : to create and maintain vat parameters

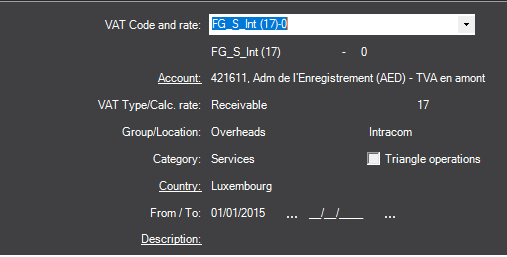

Consisting of the following self-explanatory parameters :

- VAT Code and rates : code and rate

- Account : Account on which the VAT will be posted if applicable

- Group / Location : Overhead – investment – purchase / sale Intracom – outside EEC – National

- Category : Services / goods / Services and goods

- Country : Country of the return

- From / to : Date of creation of the vat code / Date of deactivation

- Description : Description to associate with a VAT code used in client billing reports to refer to the applicable law article related to VAT exemption (text displayed each time the code is used)

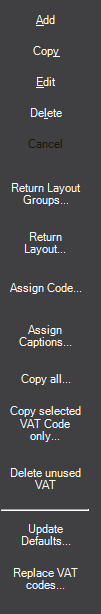

Label RETURN LAYOUT GROUPS: Allow to create all return layouts

Label VAT RETURN LAYOUT : To create la VAT return layout corresponding to the official VAT return forms. User can define formula and sub-totals.

Label ASSIGN VAT CODE : Allows user to assign a VAT code to a return layout (base amount or vat amount)

Label ASSIGN CAPTION : Rather than assigning a code to the return caption user can assign codes for a selected return caption

Label COPY ALL : To be used to copy/update ALL VAT codes from a standard to accounting entities.

Label COPY selected VAT code only : To be used to copy/update the selected VAT code from a standard to accounting entities.

Label Delete unused VAT : To be used to deleted all unused VAT code in a specific accounting entity.

Label Update Defaults : VAT codes are used as defaults and this function can replaces defaults codes when an end date has been placed on a code to replace the default with a new code (chart of accounts, automatic billing, client, supplier, Article, automatic accounting entries)

Label Replace VAT CODE : To be used to replaces VAT codes used by mistake (example FG-17 and Overheads-17 have been used but are meant to be the same. It’s possible to replace Overshead-17 by FG-17 and delete the redundant code)

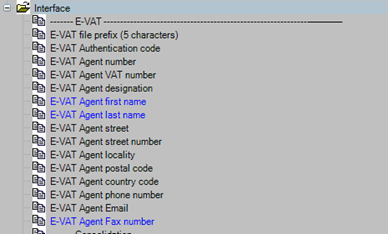

eTVA returns : In the options users will be able to fill in information required to produce a valid authenticated eTVA XML file

VAT return under XML format to upload to eCDF platform is generated from the report (Id 1163) by clicking on the interface label shown on the print select screen

IMPORT in DeMaSy utilities : XML file will be deposited in the specified directory as set in the interface parameters